Revealing How much does it Cost to Hire a CPA Easily

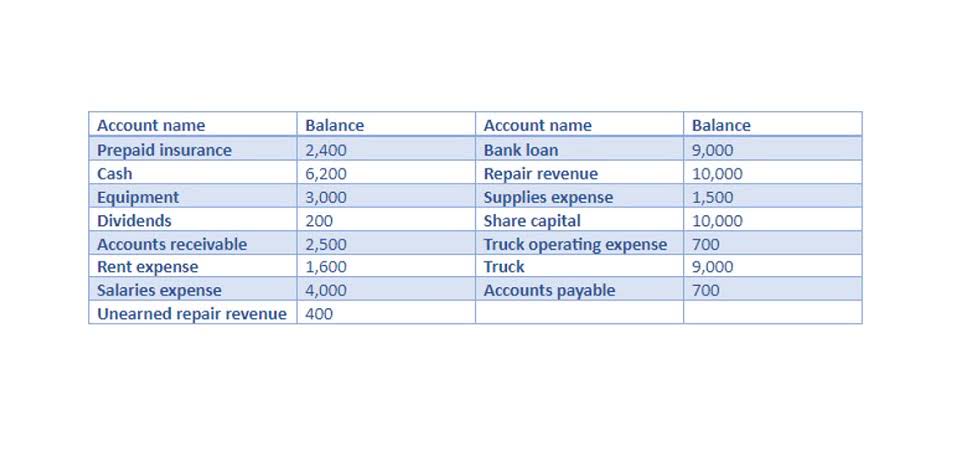

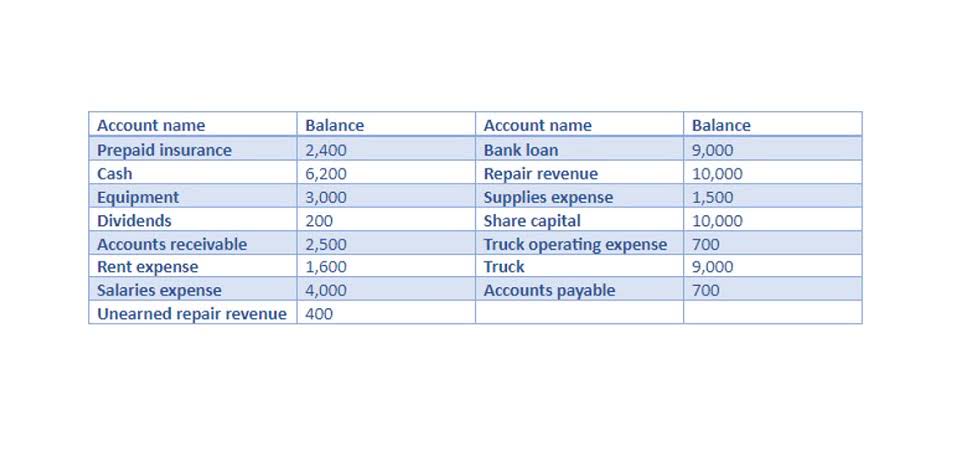

The uneasiness of not knowing your tax obligations is avoidable! Sure, we can slam things together on December 31, but that’s operating in crisis mode. Acting in planning mode throughout the year allows for better decisions and better tax savings. In other words, tax planning is an ongoing and fluid dynamic, and it should be performed methodically and incrementally throughout the year. Small business bookkeeping + analysis service is typically $190 to $500 per month depending on cadence.

Call Our Team

- Frankly speaking, once a business gets to a certain size management layers get in the way of owner access.

- While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional.

- The two tax peeps, and if applicable, a payroll peep to help with setup and training, and an accounting peep (if you are using our Accounting Services team for bookkeeping + analysis).

- Hiring an accountant can be a smart investment, especially when managing your finances becomes more complex or time-consuming.

- Hourly meetings and consultations are usually subject to the firm’s hourly bill rates and are paid in addition to the cost of the tax return deliverable.

New business formation assistance like choosing entity structure, projections, and filings may cost $1,500-$4,000. Nonprofit application services could range from $2,000-$5,000+. The cost of a CPA usually ranges from $150 to $500 per hour depending on factors like experience level, firm size, and geographic location. Partners at large metro firms often bill over $500/hour, while junior staff at smaller local firms charge $100-$150/hour. For personalized CPA cost analysis and how much does a cpa cost per month expert tax preparation services, contact Bluegrass Professional Services for a consultation tailored to your specific needs. A tax preparer might be the more affordable if your business taxes aren’t overly complex.

- The steepest cost increase happens between senior-level and partner-level CPAs, where hourly rates can more than double.

- Here’s how to communicate your fees with authority, clarity, and confidence.

- We used light research assistance to confirm 2025 ranges and trends, and we cited current public sources where helpful.

- WCG CPAs & Advisors specializes in small businesses who generally have fewer than 25 employees.

- Our Business Advisory Services (BAS) engagements also include tax advisory meetings and an end-of-year wrap-up meeting.

- Our platform is designed for both full-time students and working professionals.

Factors That Affect CPA Fees

This is sometimes also called the “registration fee.” Some states will offer discounts on CPA Exam retake fees if the candidate is retaking 2 or more exams. WCG has been remotely preparing tax returns since 2007 using secure online client portals, text messaging, videoconferencing, and other technologies. For late S Corp elections back to January, we have a split fee of $600 or $1,200… and it depends on if https://www.serralheriajeovajireh.com.br/expert-bookkeeper-in-chicago-small-business-2/ we can file your S Corp by March 15. Ideally, we attach the late S Corp election to the tax return and file both electronically.

The Ultimate Guide to Federal Income Tax Deadlines for 2026

The model you choose affects revenue, client expectations, workload, and even burnout risk. Relevant resources to help start, run, and grow your business. Your clients may also be willing to pay more if you have advanced degrees and certifications. A weekly article to help grow your firm, empower your team, and lead with confidence, curated by Karbon Magazine’s Editor in Chief.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. By implementing these strategies and taking a proactive approach to managing your finances, you can potentially minimize CPA expenses and strengthen your financial situation. CPAs who specialize in a particular industry, such as healthcare or technology, may also charge a higher rate due to their specialized knowledge and expertise. You might also like our articles about the cost of a forensic accountant, family lawyer, or setting up an LLC. Are you tired of juggling complicated spreadsheets, staying up late every April to figure out last-minute tax deductions, or worrying about potential audits? If they’re hard to reach during how is sales tax calculated onboarding, imagine what tax season will look like.

- One of the most frequently asked questions from CPA candidates just starting the process is about the CPA Exam cost.

- Different structures have different tax implications, and while it’s possible to convert your business to a different structure in the future, certain restrictions will apply.

- CPA-licensed accountants charge on average between $200 – $400 per hour in the US.

- For details, please refer to your Sunrise Banks Account Agreement.

- We help startups & small business owners stay on top of their books, taxes, and payroll with personalized CPA services tailored to your unique needs.

- Since you pay the same rate each month, fixed fees are easy to budget for, and they often end up being a better deal in the long run.

SmartAsset stated that small business owners should expect to pay between $1,000 and $1,500 on average to have a CPA firm prepare both their individual and business tax returns. Some accountants already include a single W-2 in their tax preparation fees. However, those with multiple employees or complex payroll situations will likely incur additional charges. As mentioned above, the rates charged by accountants vary.

Hey Client Name, based on the added rental property and multi-state activity this year, we’re updating your engagement to reflect that added complexity. Yet most firms are still treating clients like they’re frozen in time. Consider looking for accounting software with advanced features such as mileage tracking, invoicing, and time tracking. Accounting software could be a more budget-friendly option, even if you have to hire someone to manage the platform.